Residential Solar WORKS in Washington

During the summer, the Pacific Northwest’s long, mild days are ideal for generating solar power, and solar panels operate at greater efficiency in cooler climates. A solar system in the Puget Sound will produce 80% of the energy of an identical system in Los Angeles! Solar panels work on cloudy days too, even in the winter.

Germany receives less sunlight than the Seattle & Puget Sound regions, yet it accounts for 13.5% of the world’s solar panel electric installations. Germany is expecting to be 100% green for its national energy usage by 2050. When Germany can produce that much solar energy with less sunlight, there is no reason not to go solar here in the Northwest.

Washington State Sales Tax Exemption

The Washington state solar incentive program rewards homeowners 6.5% to 10.4% for going solar in the form of a sales tax exemption! This is a $2,000 incentive for a typical-sized system. The exemption is included in the 100% Clean Energy Act, signed into law on May 7, 2019.

The Clean Energy Act mandates that all Washington electric utilities transition to 100% carbon-neutral electric supply by 2030 and 100 percent carbon-free by 2045!

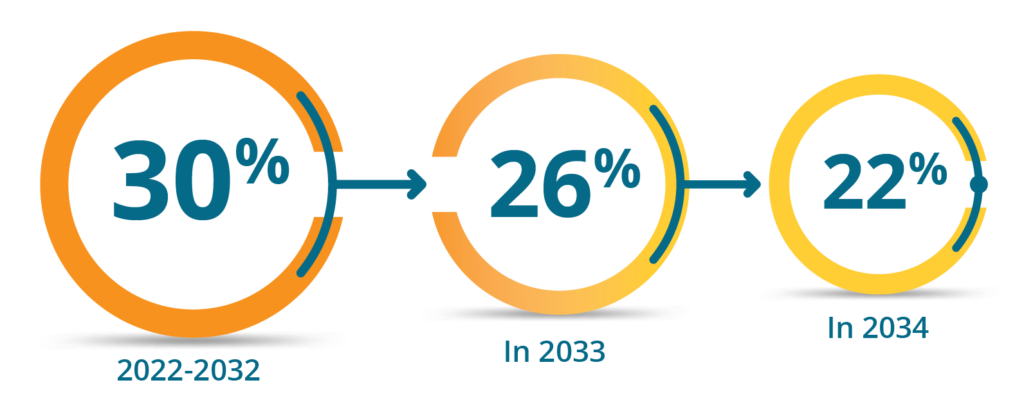

Federal Investment Tax Credit – 30%

Solar electric systems installed by Dec 31, 2025 qualify for the 30% federal solar income tax credit* (ITC). Energy storage also qualifies for the ITC.

Solar Loan – $0 Down + 90-Day Zero Payments

You own your solar system for $0 down through an outstanding local credit union (PSCCU), paying for it with a simple loan. You can pay off your loan at any time without penalty. We have three options for you, with rates as low as 6.50% (720+ credit score) and terms of 10, 15, and 20 years. PSCCU offers one free re-amortization at any time during the life of the loan.

STARTING AT

STARTING AT

STARTING AT

For a limited time only, PSCCU is offering Zero down & Zero payments for the first 90 days of a solar loan, which means free energy until your first payment is due.

Replace Your Ever-Increasing Electricity Bill With a Fixed Payment For Solar

Take control of your energy future with Sunergy’s new Solar Finance Partner, Concert Finance! Here’s how it works:

- $0 money down. No origination or hidden “contractor fees”.

- Low introductory payments for first 18 months. Adjusts after intro period depending on how much you want to contribute after taking your solar tax credit.

- 25-year term to ensure lowest possible monthly payment.

- Easy qualification process. Your Sunergy Solar Design Consultant can walk you through the process.

- Rates as low as 8.49% with qualified credit.