Utility and Tax Incentives

When you combine Washington State’s Sales Tax Exemption with 1:1 Net Metering from the utilities, plus incentives for battery storage like the PSE Flex Battery Program, the Puget Sound Region makes sense as a place for investing in rooftop solar & battery storage.

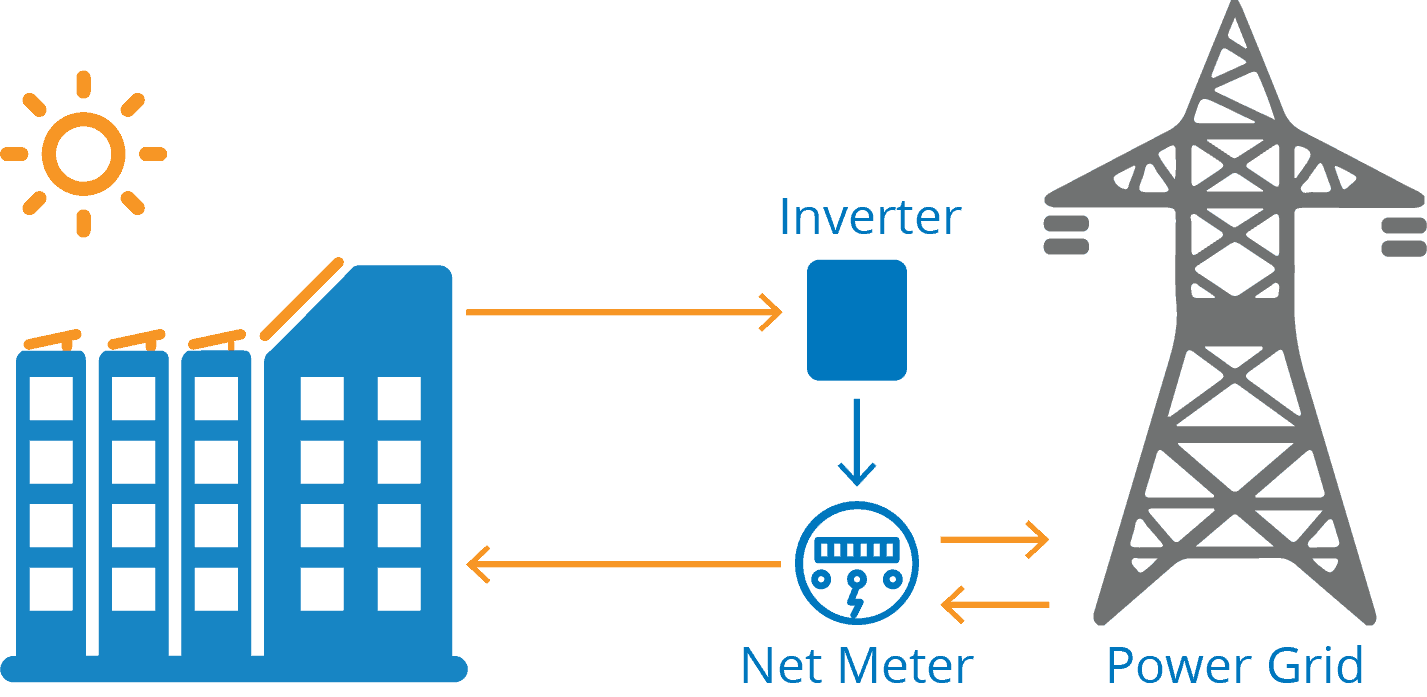

Net Metering

All utilities in Washington State are required to offer 1:1 net metering to their residential customers. In these programs, solar energy that is not used at the time of generation will be fed back to the utility grid, and you will be credited for these surplus kilowatt hours. Your monthly utility bill will be reduced by the kWhs that are produced that month along with any stored credits from previous months. To prevent over-sizing of solar systems, credits must be used up by March/April of each year or they are forfeited back to the utility.

Net metering agreements are transferable to new property owners and will also be grand-fathered in when the programs are closed to new enrollees. Going solar before net metering ends is highly recommended!

Washington State Sales Tax Exemption

The Washington state solar incentive program rewards homeowners 6.5% to 10.4% for going solar in the form of a sales tax exemption! This is a $2,000 incentive for a typical-sized system. The exemption is included in the 100% Clean Energy Act, signed into law on May 7, 2019.

The Clean Energy Act mandates that all Washington electric utilities transition to 100% carbon-neutral electric supply by 2030 and 100 percent carbon-free by 2045!

PSE Flex Battery Program

With the Flex Batteries program, you can earn rewards automatically while helping to ensure stable energy for the community. Plus, you’ll have peace of mind with backup power for your home if an outage occurs.

Here’s how your participation benefits you and your community:

- Earn money: Enroll in Flex Batteries and earn $1,000 per battery, plus up to $500 per year with no action required.

- Security during power outages: Solar batteries automatically back-up your home during power outages, ensuring that your refrigerator keeps running, the heat stays on, and your life can continue as normal.

- Support your community’s energy stability: Batteries can help take strain off the energy grid during high-energy use periods and create a more stable energy system.

PSE utility customers only. The program currently works with both Franklin-WH and Tesla Powerwall.

PSE Flex Batteries “Enhanced Incentives”

The PSE Enhanced Incentives make battery energy storage systems more affordable by offsetting the upfront equipment and installation costs. You may be eligible to receive an instant rebate of up to $10,000 towards your battery installation! This is in addition to the $1000 per battery for enrolling in Flex Batteries, plus up to $500 per battery each year. Contact Sunergy to find out if you qualify.

Increase Home Value

Having a residential solar energy system on your property is known as a capital improvement that adds to your property’s value. This means that you can potentially sell your home faster and for more than homes without solar. Your investment in efficient, clean solar power also adds to the tax basis of your home. If you sell the home, this tax-based investment can be deducted from the sale’s price, reducing the amount of the price that is counted as profit. This reduces the taxes taken from the sale and may be able to help you avoid capital gains taxes on appreciation.