It’s difficult to believe, but we’re already halfway through 2025—and if you’ve been thinking about going solar, this timing matters more than you might realize. The solar tax credit could expire!

That’s because the 30% Federal Solar Investment Tax Credit (ITC)—one of the most powerful financial incentives for solar—may not last at its current level much longer.

At Sunergy Systems, we want Washington homeowners to get the maximum savings possible. In this blog, we’ll break down everything you need to know about the tax credit—and why acting this year is essential.

What Is the Federal Solar Tax Credit?

A Major Savings Opportunity

The Federal Solar ITC lets you deduct 30% of the total cost of your solar system from your federal income taxes.

That’s not a deduction on your income—it’s a dollar-for-dollar credit on what you owe in taxes.

What’s Covered?

The credit applies to:

-

Solar panels

-

Inverters

-

Racking and mounting equipment

-

Permitting fees

-

Electrical upgrades (if needed)

-

Battery storage (if installed with solar)

Why Timing Matters: Changes May Be Coming

Scheduled Step-Downs

While the tax credit is currently at 30%, it won’t stay that way forever:

-

The current credit was extended under the Inflation Reduction Act through 2032

-

However, changes in legislation or budget priorities could cause early reductions

-

Historically, incentive programs often get adjusted—or phased out—sooner than expected

2025 Is a Safer Bet

By installing now, you guarantee that you’ll lock in the full 30% credit—before any possible reductions or policy shifts.

Maximizing Your Savings in 2025

Get the Credit AND Beat Rate Increases

In addition to the federal tax credit, installing solar this year lets you:

-

Start saving on electric bills sooner

-

Hedge against rising utility rates (Washington utilities are proposing increases for 2026)

-

Build up net metering credits for the winter months

Pair With Battery Storage

If you install solar + battery storage this year:

-

The battery is also eligible for the 30% credit

-

You’ll enjoy backup power for outages

-

You’ll future-proof your system for evolving utility rate structures

What About State Incentives?

Washington also offers additional local incentives:

-

Sales tax exemptions for solar installations

-

Net metering that credits excess solar generation at retail rates

-

Various utility-specific rebates in some regions

Combined with the federal tax credit, these programs make going solar in Washington even more affordable.

How Long Does the Process Take?

Permitting + Installation Timeline

A typical solar project in Washington takes:

-

1-2 weeks for site assessment and system design

-

2-8 weeks for permitting (depending on local jurisdiction)

-

1 week for installation

-

1-2 weeks for utility interconnection and net metering approval

Why Start Now

By starting your project this summer, you:

-

Ensure your system is installed this calendar year

-

Lock in the 30% tax credit for 2025

-

Maximize solar production during Washington’s sunniest months

How Sunergy Systems Helps

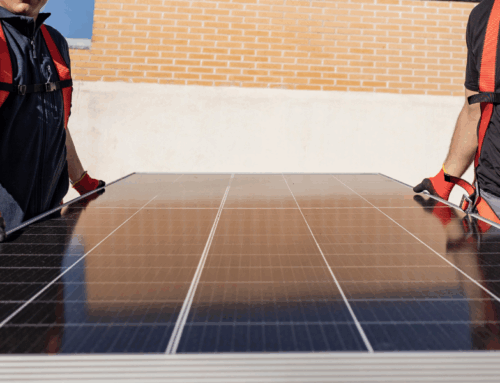

We guide you through every step:

-

Design — custom systems optimized for Washington homes

-

Permitting — we handle all paperwork

-

Financing — we offer affordable options and explain tax savings

-

Installation — our expert crews deliver high-quality work

-

Support — we’re here for you long after installation

Conclusion: Don’t Miss Out

If you’ve been thinking about going solar, 2025 is the year to do it.

Between the 30% federal tax credit, state incentives, and rising energy costs, there’s never been a better time to make the switch.

Contact Sunergy Systems today for your free consultation—and let’s get your project started before the tax credit changes.